Things to consider before starting your small business

by Natalie Macdonald-Govender

Starting your own business is an exciting adventure, but nerve-wracking at the same time. It is important to have a well-thought out strategy when setting out to start your business. Protecting your business legally should be considered before you put any plans into action, and not an after-thought!

Sole Proprietorship/ Company? What should I do?

We all know the famous stories of now-wealthy entrepreneurs, who started their business in their garage. Contrary to popular belief, you do not need a company or an office to get going with your business.

A common mistake people make is confusing the term “starting a business”, with “starting a company.” You do not need to start a company in order to create a business!

That being said, you need to carefully establish what you would hope to achieve in your business before deciding on which vehicle you will use to house your business in.

Sole proprietors

A sole proprietor is usually an individual who decides to start a business by himself, without registering a company but to transact in their own name, or use a trading name, for example: “John Smith trading as John Smith Plumbers Supreme”. Someone may, for example, decide against acting as a sole proprietor due to liability issues. If liability issues are not a major concern for you, due to the low-risk nature of the services/goods you offer, conducting business as a sole proprietor may suit you perfectly as it can offer less red-tape in the areas of governance and lower running costs. When it comes to providing security for obtaining finance, a sole proprietor would usually offer his own personal assets as security for the loan (where required by the lender). A sole proprietor’s assets are not protected if sued and therefore, for example, you may find your home at risk if you are unable to satisfy a judgment debt or go insolvent as a result of the business.

Companies

It was previously possible, when registering a company, to register a private company (Pty Ltd) or a close corporation (a CC). It is no longer possible to register a close corporation in South Africa, but previously registered CC’s may still continue to operate as one. Private companies are now the norm, which can be registered via the Companies and Intellectual Property Commission, or you could purchase a shelf company. It is now relatively quick to register a company or purchase a shelf company. Companies are beneficial in that the company is a separate juristic entity with its own juristic personality. The company is in an event of legal action usually sued, and not the directors (with some exceptions). There is, however, also the need to comply with the provisions of the Companies Act 71 of 2008 when operating as a company and ensure that good-governance principles are upheld.

Funding your small business

It is possible to start a business without much capital funding. That being said, it also depends on your market and the type of business you wish to start. For example, a painter starting a business may only need relatively basic equipment to start out. A restaurant on the other hand will usually have huge start-up expenses, such as up-front lease fees, a lease deposit, staff expenses, furniture and equipment. Most banks will usually need some security before advancing a loan (and not to mention that the borrower should have a good credit record, which if you have never traded before could mean that you have a non-existent record). When approaching lenders for finance, you would usually need to have some kind of security and/or surety for the loan, and at least prepare projected financial statements with a cash flow statement, as well as have a business plan. It is worthwhile to keep on the look-out for small business conferences/ workshops, as it can be a resourceful place to obtain more information on financing arrangements, or find out about companies that are eager to assist grass-root businesses or small businesses with seed funding.

Financial Statements

It is good practice to always have up-to-date financial statements on hand. As a sole proprietor, financial statements are not in most circumstances a statutory requirement. Companies are however, due to recent developments with the Companies and Intellectual Property Commission, now required to submit financial statements when submitting annual returns to the Companies and Intellectual Property Commission. Failure to submit financial statements can result in penalties and fines.

Red Tape

Undertake a risk-assessment on the nature of your work. Is there any legal red-tape? Do you need any specific licensing before commencing with that trade? Think food-license, health license, liquor license, planning approval, municipal by-laws, trade and industry regulations as well as company legislation and be sure to seek legal advice before commencing operations. Claiming ignorance of the law does not work!

Tax Compliance

Companies and sole proprietors alike need to ensure that they are tax compliant. It is essential to file tax returns on time as well as to make payment of any amounts due timeously. Tax compliance includes registering for value-added tax once you expect that your turnover will exceed R1 million in any 12 month period (note- not profit, but turnover!) which can be relatively easy to exceed. It should be noted that the VAT registration requirements also apply to sole proprietors. There are penalties for failing to register when registration should have taken place.

A sole proprietor will not file a separate tax return for the business, but in his/her own name. It is essential to know what expenditure may be deducted in terms of the Income Tax Act 58 of 1962 and what is regarded or deemed to be income or accrued income, to ensure that your tax returns are filed correctly.

With companies, payment for services to a director is usually treated as a salary (remuneration) taxable at the directors relevant tax rates, whilst a payment to a shareholder (aside from repayment of a loan account) is deemed as a dividend (currently taxed at 20%), which dividends tax must be paid to SARS. A company must therefore comply with filing the employee tax returns as well.

There is also a duty to keep records for a period of least five years after the relevant tax period.

Conclusion

Get advice. Plan properly. It’s your dream and your business after all!

Our Corporate & Commercial Department can assist with registration of companies, supply of shelf companies, company administration, drafting of Service Level Agreements, shareholder agreements, sale of business agreements, sale of share agreements, memoranda of incorporation documents, information-use agreements (for POPI purposes), preparation of lease agreements as well as provide advice for starting your business.

Henning Pieterse | Partner

Areas of Expertise: Corporate & Commercial Law

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Evictions: Know the law

The Prevention of Illegal Eviction from and Unlawful Occupation of Land Act 19 of 1998 (“PIE Act”) affords protection to tenants against unlawful eviction.

Regarding the eviction process, the PIE Act stipulates, in general terms, the following:

- there are certain procedures must be followed;

- notice of the intention of getting a court order must be given to the tenant;

- the landowner or landlord must apply to the court to have a written notice served on the tenant; and

- the notice must be served on the tenant at least 14 days before the date of the hearing.

The Rental Housing Tribunal

The Rental Housing Tribunal (RHT) was established in terms of the Rental Housing Act 50 of 1999, which regulates the relationship between landlords and tenants, unlawful evictions as well as unlawful notices to vacate. From the moment the lease agreement terms are breached, the landlord may lawfully cancel the agreement (in terms of the lease agreement provisions) and the tenant then becomes an illegal occupier. An example of a breach occurring would be where a tenant fails and/or refuses to pay rent, or does not make payment of rent timeously.

The PIE Act states that no one may be deprived of their property except in terms of law of general application. Arbitrary deprivation of property is unlawful but no-one may take the law into his/her own hands. Additionally, no-one may be evicted from their home, or have their home demolished without an order of court made after considering all the relevant circumstances. It is desirable that the law should regulate the eviction of unlawful occupiers from land in a fair manner, whilst recognising the right of land owners to apply to a court for an eviction order in appropriate circumstances. Special consideration should be given to the rights of the elderly, children, disabled persons and particularly households headed by women.

The service of a notice does not guarantee that the illegal occupier will leave the premises as the court will only grant eviction if it is “just and equitable”. The owner must have reasonable grounds for eviction and alternative accommodation must be available to the unlawful occupier.

Should you require assistance with a lease agreement or an eviction, contact our litigation department.

Albin Wagner | Partner

Areas of Expertise: Consulting and representing German-speaking clients in all matters | Civil Litigation including Commercial & | Matrimonial Disputes | Representation of parties in property transactions | Disputes relating to deceased & insolvent estates, insurance, neighbours, local authorities, building and construction contracts | Contract and Commercial Law | Sports Law & | Administration

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Make sure your will is properly executed when you sign!

When executing a will, it is important to ensure that you have signed it correctly and in accordance with the Wills Act 7 of 1953 (the “Wills Act”).

The formalities for the valid execution of a will are set out in the Wills Act. Portion of Section 2 (1) of the Wills Act, Act 7 of 1953, reads:

No will executed… shall be valid unless the will is signed at the end thereof by the testator… and such signature is made by the testator… in the presence of two or more competent witnesses present at the same time and such witnesses attest and sign the will in the presence of the testator and of each other…”.

Therefore, in order for a will to be validly executed, one of the requirements is that it has to be signed by the testator in the presence of two competent witnesses (who will not benefit from the will in any way, therefore the persons signing as witnesses should not be heirs or an executor of the will). If this provision is not complied with, the will may be invalid.

In Twine and Another v Naidoo and Another [2017] ZAGPJHC 288; [2018] 1 All SA 297 (GJ) the two daughters of the deceased, who lost out on their inheritance in terms of the will of their father, claimed that it was never their father’s intention for his much younger lover to inherit his total estate. The testator was 85 years old at the time of his death and he had been living with a woman 38 years his junior for 8 years.

The deceased executed two wills during his lifetime. One on 6 November 2011 (“the 2011 will”) and another on 7 January 2014 (“the 2014 will”). The 2014 will was signed shortly before his death leaving the bulk of his estate to his much younger lover. The daughters of the deceased claimed the 2014 will was invalid as there were “suspicious” circumstances. They claimed their father either did not sign the 2014 will himself or, if he did, that he lacked the mental capacity to execute a valid will by reason of dementia. The daughters of the deceased were not successful in proving that the deceased’s signature was a forgery despite the fact that three handwriting experts testified.

Another witness called to testify was a witness to the 2014 will. Her testimony focused on the circumstances surrounding the signing of the 2014 will. She signed the will as a witness. She testified that she and her husband met the deceased in the street. As they were acquainted they naturally engaged in social conversation. She and her husband were informed that the deceased was on his way to the police station to sign a will. She and her husband were asked if they would accompany the deceased in order to sign the will as witnesses. They were assured that the process would not take long so they agreed to assist.

She and her husband signed the will and immediately left. They were the first to sign the will. At the time they signed the will the deceased had not signed the will. They left before witnessing the deceased signing the will. Hence, the 2014 will was not signed by the deceased in their presence even though it reflects their respective signatures as witnesses.

The evidence assessed collectively established that the deceased signed the 2011 will and also that he signed the 2014 will. However, the 2014 will was signed by the deceased after the two witnesses to the will had already left and therefore was signed in their absence.

The court referred to Section 2 of the Wills Act in terms whereof no will is valid unless the signature made by the testator is made “in the presence of two or more competent witnesses present at the same time”. The court confirmed that this requirement is mandatory and, if not met, the will is not valid for want of compliance with a statutorily required formality.

The court therefore found the 2014 will to be invalid and, as there was no evidence that there was any irregularity in the execution of the 2011 will, the 2011 will was declared the will of the deceased.

This judgment of the High Court once again emphasizes the importance of complying with the Wills Act. If you have not executed your will correctly, it is essential to arrange for a preferably new will to be re-executed as soon as possible. It is advisable to seek legal advice when preparing your will to ensure that it is correctly executed and therefore a valid will.

Roald Besselaar | Partner

Areas of Expertise: Conveyancing, Estate Law, Wills, Trusts, Curatorships, Property Law

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Memorandum of Understanding: Binding and enforceable or not?

It often happens that parties to a business venture have discussions which they then decide to set out in writing, encapsulating the salient points of their understanding and setting out a proposed timeline for the finalisation of the various substantive agreements to be concluded in future.

These expressions of understanding and/or intent can adequately be referred to as a Memorandum of Understanding (“MOU”), but do these MOUs create a legally binding agreement and, if not, how can the parties thereto protect themselves and ensure that such agreement will be legally binding?

There is a common misconception that MOUs are always non-binding. MOUs can in fact be binding, non-binding or partly binding and partly non-binding, it all depends on the intention of the parties and the exact wording of the MOU. But uncertainty is rarely a good thing in the context of legal documentation and a poorly drafted MOU containing binding provisions, has the potential to haunt the signatories in Court if the envisaged substantive agreements are never signed. It might also make it difficult for you to raise and negotiate new points which were not included in the MOU.

It will be a question of the law of contract as to whether an MOU is binding or not. Conversely, if the essential terms are not all present, an MOU will be held to be void for vagueness.

The legal binding nature of an MOU was considered in the matter of Southernport Developments (Pty) Ltd v Transnet Limited [2004] JOL 13030 (SCA), where the court of first instance found that there was no agreement between the parties, and the mere fact that there was an obligation to negotiate in good faith did not take the matter any further, replying upon the decision in Premier, Free State and Others v Firechem Free State (Pty) Ltd which held that:

“An agreement that parties would negotiate to conclude another agreement is not enforceable, because the absolute discretion vested in the parties to agree or disagree.”

Such reasoning can prima facie not be faulted by virtue of the fact that the parties should be allowed to negotiate the terms and provisions of an agreement, and in particular the essential terms of the agreement. Should the parties during the course of their negotiations not be in a position to reach finality on the essential terms of an agreement, then an agreement should not be held to have been concluded. However, where parties have already put their “flag to the mast” and expressed their intention to conclude an agreement in regard to a certain matter, can it be expected that one party can hold the remaining party to such an expressed intention?

The Supreme Court held that the present case had to be distinguished from the Firechem case by virtue of the fact that the parties had created a specific mechanism to ensure that an agreement was concluded. This mechanism was the dispute resolution mechanism of arbitration, and provided that in the event of the parties not being in a position to agree on any of the terms and conditions, such dispute would be referred to an arbitrator.

The latter case sets out the appropriate protective measures to be used by any third party that is a party to an “agreement to agree”. It is imperative that such a letter of intent/memorandum of understanding contains a provision, which provides that in the event of the parties not being in a position to reach agreement on any of the terms of the proposed agreement, that such a dispute be referred to arbitration.

It is important to note that an MOU is never a prerequisite and can often serve to delay the drafting and negotiation of the substantive agreements. Practically speaking, an MOU cannot always be avoided, for example, on particularly complex deals or where a negotiating party treats an MOU as a deal breaker and insists that one be drafted. A well-drafted MOU will be partly binding and partly non-binding and will expressly state at the outset which clauses are binding and which clauses are non-binding.

A well-drafted MOU which clearly sets out which clauses are binding, and which are non-binding can set the tone for the negotiation of the substantive agreements to be drafted at a later stage and makes it difficult (but not impossible) for your counterparty to raise fresh issues. Where an MOU is unavoidable then it should be taken seriously. Almost inevitably it will be a document which creates rights and obligations and you need to be sure that the MOU properly reflects your understanding of the arrangements.

The prudent approach is to consult your attorney before committing to an MOU.

Reference list:

- The Law of Contract in South Africa (2006) Fifth Edition: RH Christie [LexisNexis Butterwoths]

- Southernport Developments (Pty) Ltd v Transnet Limited [2004] JOL 13030 (SCA)

For more information regarding commercial matters, please contact:

Henning Pieterse | Partner

Areas of Expertise: Corporate & Commercial Law

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Joint ownership: How do I terminate without the co-operation of the other joint owner?

This article gives a brief overview of the nature of joint ownership, and specifically focuses on the termination of joint ownership and the remedy available to a joint owner who wants to terminate the joint ownership, but cannot achieve it because of a lack of co-operation of the other joint owner.

Nature of joint ownership

Joint owners own undivided shares in the property which they own jointly. Consequently, the joint owners cannot divide the joint property while the joint ownership remains in existence. A joint owner also cannot alienate the property or a part thereof without the consent of the other joint owner. The rights in respect of the joint property need to be exercised jointly by the owners thereof.

Ways in which joint ownership can arise

Joint ownership can come into existence by way of an inheritance in which an indivisible property is left to more than one person in undivided shares; by way of a marriage in community of property, by the mixture of movable property in such a way that it forms a new movable item or by way of an agreement in terms of which the parties agree to jointly buy a property and that both will have equal indivisible shares in the property.

Division of joint property

Any joint owner can claim the division of the joint property according to that joint owner’s share in the property. It is a requirement for the division of the joint property that the parties need to try to divide the property among themselves first, before approaching the Court for an action to divide the property, which action is called the actio communi dividendo.

The underlying principle of the actio communi dividendo is that no co-owner is normally obliged to remain such against his will. If there is a refusal on the part of one of the co-owners to divide, then the other co-owner can go to Court and ask the Court to order the other to partition. The Court has a wide discretion in making a division of the joint property, which is similar to the discretion which a court has in respect of the mode of distribution of partnership assets among partners.

The Court may award the joint property to one of the owners provided that he/she compensate the other co-owner, or cause the joint property to be put up to auction and the proceeds divided among the co-owners. Where there is no agreement between the parties as to how the joint assets are to be divided a liquidator is ordinarily appointed, and he can then sell the assets and divide the proceeds, if it is not possible to divide the assets between the parties. If the immediate division of the joint property will be detrimental to the parties, the Court can order in certain cases that the division or the sale of the property be postponed for a period.

It is beneficial that there exist means to divide assets which are jointly owned by parties, who no longer wish to be co-owners, but who cannot reach an agreement on the division of the assets. Without such an action, people might be stuck with a property which they derive no benefit from because it is in the possession of the other co-owner, who refuse to sell the property.

For more information regarding property and property disputes, please contact:

Lisa Visagie | Partner

Areas of Expertise: Property Law | Conveyancing

Rifqah Omar | Partner

Areas of Expertise: Litigation | Professional Discipline Law | Muslim Personal Law | Curatorship applications and administration | Administration of estates

[1] Inleiding tot die sakereg, Van Niekerk & Pienaar, Juta, p 53 – 61.

[2] Robson v Theron 1978 (1) SA 841 (A).

[3] 1978 (1) SA 841 (A).

[4] 1978 (1) SA 841 (A).

[5] Van Niekerk & Pienaar, p 61 – 62.

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Tobacco and e-cigarettes – The way forward

The Minister of Health released the Control of Tobacco Products and Electronic Delivery Systems Bill of 2018 earlier this year.

The main focus of the Bill is to regulate where smoking can take place, together with the sale and advertising of tobacco products and electronic delivery systems, including packaging. The aim is to limit the exposure of non-smokers to the hazardous effects of second-hand smoking.

Electronic delivery systems include what is commonly known as ‘e-cigarettes’. Electronic cigarettes (or e-cigarettes) are often marketed as less harmful and a mechanism to quit smoking. However, the Minister of Health has chosen to regulate these devices in the same manner as cigarettes, as the long-term effects of e-cigarettes on our health have not been established.

The key elements of the Bill include:

- You may not smoke:

- indoors in a public place (zero tolerance on indoor smoking policy);

- on public transport (e.g. buses or trains);

- in the workplace;

- within a prescribed distance from a place designated as a non-smoking area (this includes common areas in housing complexes);

- in any motor vehicle where there is a child under the age of 18 years and there is more than one person in such a motor vehicle; and

- in a private residence if you run a commercial childcare facility on the premises, if you employ a domestic worker, or provide schooling or tutoring there.

- Manufacturers must use standardised packaging, with only the brand name and the product name appearing on the packaging, together with information advising of the health hazards posed by smoking (including images).

- No advertising, promotion or sponsorship of tobacco products and electronic delivery systems is permitted, whether directly or indirectly. Retailers may not advertise or display these products. They are also not allowed to sell to persons under the age of 18 years.

The penalties faced by offenders can vary from a fine and/or a jail sentence of up to three months, to a fine and/or a jail sentence of up to 10 years (depending on the seriousness of the offence). The fine for lighting up in a non-smoking area will be R500.

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Non-resident purchasers – What to consider

We often receive queries from non-resident clients who wish to invest in property in South Africa.

There are various considerations to bear in mind when purchasing property. This article briefly discusses what a non-resident should consider, before purchasing property in South Africa.

Should I purchase property in my personal capacity, a trust, or in the name of a company?

This will depend on your specific needs and requirements. In order to assess whether to purchase property in their personal capacity, or to utilise an entity to purchase the property, clients should be aware of the various tax implications, exchange control regulations and governance requirements in respect of each option. For example, under certain circumstances the failure to obtain exchange control, approval where approval is required, can result in the transaction being null and void.

Marriage considerations

When purchasing property, according to South African law, a spouse whose marriage is governed by foreign law can usually buy immovable property in his or her name only, without requiring the consent of the other spouse. However, should he or she in future decide to sell the immovable property, he or she will need his/her spouses assistance to do so. The spouse of the property owner would have to co-sign all transfer documents to give effect to the sale.

Problems in the transfer process sometime arise when clients, who were married at the time of purchasing the immovable property, are divorced by the time that they decide to sell the immovable property. It is essential to keep a copy of the relevant divorce order and consent paper (and a duly sworn translation thereof, where applicable) as the Deeds Registry will insist on receiving same, and accordingly the seller will not be able to sell without acceptable proof of the divorce.

Tax considerations

Non-residents should bear in mind that all income from a South African source is taxable within South Africa (subject to a few exceptions). The sale proceeds of a property, as well as rental income, would be taxable in South Africa. In this regard, non-residents should take note that capital gains tax is not a separate tax, but the taxable gains (known as the “capital gains”) are included in the non-resident’s taxable income in South Africa.

In addition, non-residents are still liable for estate duty in South Africa on South African assets (subject to certain exceptions). It is recommended that when the client purchases a property, that he or she prepare a South African will which will provide for how their South African estate will devolve.

A non-resident should always consult a tax advisor to advise on various tax implications before moving to South Africa and/or purchasing immovable property in South Africa.

Purchasing via a trust

A foreign trust must be registered at the local office of the Master of the High Court, and be authorised to act in terms of the letters of authority issued by the Master. Unless the Master of the High Court in South Africa has issued letters of authority to the trustees, the foreign trust cannot enter into purchase agreements in South Africa relating to South African assets.

Accordingly, it follows that without letters of authority, any purchase of property is void from the start. Section 8 of the Trust Property Control Act provides that, where a person has been appointed outside of SA as a trustee, the Master may authorise such trustee, and the Act will apply to such foreign trustee in respect of property located in South Africa. Section 6(1) of the Act provides further that a person can only act in their capacity as a trustee if authorised by the Master. If the foreign trustee signs a deed of sale without having authorisation from the Master, such an agreement would be void. It should be noted that it is quite likely that in applying for letters of authority for a foreign trust, the Master may ask that a South African independent trustee be appointed and/or security to the satisfaction of the Master be lodged by the trustees.

Taking all of the above into account, it may be a better option to use another entity or to register a local trust according to the laws of South Africa. We suggest that when seeking to register a foreign trust in South Africa, non-resident clients seek legal advice before doing so. At the moment, the capital gains tax inclusion rate for trusts is very high at 80%.

Purchasing via a company or close corporation

A foreign company can be registered as an external company in South Africa, but registration with the Companies and Intellectual Property Commission can be challenging. It may be easier to register a local company in South Africa and shelf companies are frequently used. It should be noted that the capital gains tax inclusion rates for companies is currently 80%, and dividends tax is levied at 20%.

Funding the property purchase

We are often asked whether non-residents can apply for mortgage bond finance in South Africa. In most instances, non-residents can only qualify for a maximum of 50% of the purchase price, due to exchange control and local banking laws. Clients should also be aware that transferring funds in foreign currency to South Africa can take longer. It is even possible that a client could suffer foreign currency losses as a result of the transfer and it is therefore advisable to seek advice before transferring funds.

Always seek advice

It is advisable to seek advice before making any investment, to avoid red-tape or issues arising in future. Our Corporate & Commercial department specialises in non-resident advice and can assist you with your tax queries.

For more information regarding commercial and tax advice, please contact:

Henning Pieterse | Partner

Areas of Expertise: Corporate & Commercial Law

Erlise Loots | Partner

Areas of Expertise: Tax | Curatorships | Trusts | Estates | Exchange Control | Non-resident services and advice

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Litigation versus mediation

Litigation is the primary method of dispute resolution in the South African justice system. However, there are disadvantages attached to it, such as:

- the adversarial nature of the process, which often leads to further conflict between the parties involved in the litigation;

- the highly complex, costly and time-consuming nature of litigation; and

- court rolls having become overburdened due to the rapidly increasing volume of litigation at court, resulting in long waiting periods before matters are heard at court.

As a result, alternative dispute resolution (ADR), which includes mediation, has become popular as a faster and potentially cheaper alternative to the process of litigation.

There are certain areas of law which make provision for mediation to be used as a way to resolve disputes between the parties. For instance, the Labour Relations Act (“LRA”) aims to provide simple procedures to resolve labour disputes through statutory (prescribed by law) conciliation, mediation and arbitration through the Commission for Conciliation, Mediation and Arbitration (“CCMA”) or through accredited independent ADR services.

In practice, most disputes are resolved within a non-legal context by means of informal dispute resolution processes such as negotiation and mediation.

Depending on the nature of your dispute, mediation may assist you in resolving your matter amicably, speedily, and in a more cost-effective manner, as opposed to dragging your dispute through the lengthy process of litigation.

For more information regarding litigation and alternative dispute resolution, please contact:

Clint van Aswegen | Partner

Areas of Expertise: Commercial Litigation | Civil Litigation | Property Litigation | Employment Law | Insolvency Law

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

A body corporate’s right to issue fines

In an estate or sectional title scheme, it is challenging to ensure that everyone will stick to the conduct rules. To support a harmonious living environment, the body corporate sometimes needs to enforce the rules and issue fines to the transgressors. This raises the question of what the powers of the body corporate are, in terms of issuing and enforcing fines.

Each body corporate may choose what rules to formally incorporate into their code of conduct unless a rule is already part of the conduct rules in terms of the Sectional Titles Schemes Management Act. Any rule made and incorporated into the code of conduct has to be reasonable, fair and equally applied to all owners and residents. This is necessary to ensure that subsequent fines, based on the breach of a rule, are enforceable.

A written notification of a fine must be sent to, and received by, the owner or resident.

The correct process to be followed:

1. Complainant(s) to lodge complaint

A complaint must be lodged in writing or through an incident report to the trustees or the estate’s managing agent.

2. Notice of particulars of the complaint

The owner and the tenant, or the resident, (the offender) must be given a notice containing the particulars of the complaint as well as reasonable time to respond to the complaint. The offender must also be given enough information regarding the incident, including the rules that he or she may have broken. He or she must further be warned that if he or she persists with such conduct or contravention, a fine will be imposed.

3. Second notice

Should the offender persist with the conduct complained of, a second notice may be issued in which it is noted that the contravention is continuous or has been repeated. The offender must then be invited to a trustee meeting where he or she will be given an opportunity to present his or her case.

4. The hearing

Before a fine can be imposed, a hearing must take place. In the meeting, witnesses may be called to testify in favour of the offender and the offender may present his or her side of the story. The complainant(s) who lodged the complaint may also be cross-examined.

Once the hearing is over, the trustees must review the evidence presented by both sides and make a decision on whether or not to impose the fine.

If a fine is imposed, the amount should be reasonable, substantial and proportionate to the purpose of the penalty.

For further information regarding sectional titles schemes, please contact:

Robert Ferrandi | Partner

Areas of Expertise: Property Law | Conveyancing

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Recent judgment on the placement of temporary employees by labour brokers

The Constitutional Court recently delivered a landmark judgment regarding the placement of temporary employees by labour brokers.

It has become common practice for labour brokers to place temporary employees with clients. This often results in a situation where a temporary employee is placed with a client for an indefinite period, with no prospect of permanent employment. It also creates a conundrum for temporary employees, who are not able to bring any labour claims against the client of the labour broker, as the labour broker is regarded as the employer of the temporary employee.

The judgment by the Constitutional Court in Assign Services (Pty) Ltd v National Union of Metalworkers of South Africa and Others concerned an appeal from the Labour Appeal Court and dealt with the interpretation of Section 198A(3)(b) of the Labour Relations Act (the “LRA”).

This section of the LRA provides that, after a period of not less than three months, a temporary employee who earns below the stipulated income threshold is deemed to be the employee of the client of the labour broker.

The interpretation of this provision was brought before the courts, as the section was not clear on whether, after a period of three months, the temporary employee ceased to be an employee of the labour broker and became an employee of only the client, or whether a temporary employee became an employee of both the labour broker and the client.

The CCMA and the Labour Court considered the matter, which was then taken on appeal to the Labour Appeal Court. The Labour Appeal Court found that the client of the labour broker became the sole employer of the employee after a period of three months, and that the employee ceased to be an employee of the labour broker.

The finding of the Labour Appeal Court was upheld by the Constitutional Court. For the first three months of placement by the labour broker, the employee will remain an employee of the labour broker. Thereafter, the employee will become an employee of the client with whom he or she was placed by the labour broker. The Constitutional Court found that this finding is consistent with the spirit of Section 23(1) of the Constitution, which provides that “everyone has the right to fair labour practices”.

This ruling is expected to bring about much-needed change in the labour broker industry. Clients of labour brokers should be aware of the implications of this judgment.

For further information regarding labour matters, please contact:

Clint van Aswegen | Partner

Areas of Expertise: Commercial Litigation | Civil Litigation | Property Litigation | Employment Law | Insolvency Law

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

A short overview of the implications of the National Health Insurance Bill

The Minister of Health recently released the National Health Insurance Bill of 2018 (“NHI”) for public comment.

The NHI Bill aims to give effect to Section 27 of the Constitution that provides that everyone has the right to access to healthcare services. The State must take reasonable legislative and other steps, within its available resources, to achieve these rights.

The purpose of the NHI Bill

The main aim of the NHI Bill is to provide comprehensive healthcare services for all South Africans and residents irrespective of their ability to financially contribute to the National Health Insurance Fund (to be established). The Bill applies to public and private healthcare providers but not to military healthcare providers.

The Bill refers to a National Health Insurance Fund (“the Fund”) which will be the only public purchaser and financier of health services in South Africa. The Fund may enter into a contract on behalf of its members with healthcare providers, who are certified and accredited, to purchase healthcare services.

Who will it apply to?

The members of this Fund are South African citizens, permanent residents and their dependents. Asylum seekers and refugees who have not been granted refugee status also qualify but only for limited benefits, for example, emergency healthcare services.

How will it be funded?

At this stage of the legislative process, the Bill offers no clear insight into how the NHI will be funded. The Bill only states that the Minister of Health, in consultation with the Minister of Finance, determines the budget and allocation of revenue to the Fund on an annual basis. South Africans who already have medical aid insurance will also have to pay towards the Fund.

Will you still have the option to belong to a private medical aid?

Members of the Fund will be entitled to purchase complementary health service benefits that are not covered by the Fund through a voluntary medical insurance scheme or out of pocket, as the case may be. The impact of the NHI on private medical insurance schemes is uncertain at this time.

What is covered and how?

The NHI covers only certain healthcare services and a member may purchase services not covered by the Fund independently. The healthcare services that will be covered by the NHI are still unclear, as the definitions contained in the Bill are vague.

Members must register with a primary healthcare provider of their choice who will be the first point of call for their healthcare services. A member will not be allowed to seek the services of specialists and hospitals without first obtaining a referral from his or her healthcare provider, except in cases of emergency.

Public comment on the NHI Bill

Interested parties have three months, from the date of publication in the Government Gazette (21 June 2018), to comment on the Bill.

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

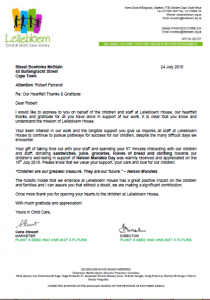

Mandela Day

For Mandela Day our staff pulled out all the stops to make sandwiches for Leliebloem house in Crawford.

We also collected children’s books for the Community Chest book drive, as well as dry foods and clothing for those less fortunate.

In the afternoon we delivered the sandwiches, together with juice and a personalised note for each child to Leliebloem House, and spent time with the children. They absolutely loved the personalised notes!

We look forward to making a difference each day.

Leliebloem is a registered NGO that operates as a Residential Child and Youth Care Centre for 60 children, aged from 4 years to 18 years old, from troubled families and backgrounds. The Centre offers the least restrictive environment for children who are placed via the children’s courts.

To read more about the amazing work that they do please visit their website www.leliebloem.org.za.

Bisset Boehmke McBlain recently held our annual “Vacation Week” program.

The purpose of this week is to host law students with a view to exposing them to the practical side of the law as well as to meet legal professionals in the field.

The students were given a tour of the High Court and local courts, were given an opportunity to meet counsel at the Cape Bar, and were addressed by some of our professionals from our various departments. The week ended successfully with a moot competition.

Bisset Boehmke McBlain is proud to promote the legal profession and enjoyed meeting lawyers of the future!

#futurelawyers #vacationstudents #law #passionateaboutlaw #BissetBoehmkeMcBlain

What to do when your loved ones can no longer care for themselves

There are several situations in life which may result in a person no longer being able to manage their financial affairs or make rational and / or informed decisions. This usually follows cases of mental illness, intellectual disability, physical disability or ageing related issues in general.

To assist these people it is necessary to bring an application for the appointment of a curator bonis and/or a curator ad personam. It is of importance to distinguish between a curator bonis and/ or a curator ad personam

According to Roman-Dutch law, a curator bonis is a legal representative appointed by a court of law to manage the finances, property or estate of another person unable to do so because of mental or physical incapacity. A curator bonis is therefor only concerned with the financial affairs of the person.

A curator ad personam, on the other hand, is a person appointed by a court of law to manage the personal affairs of another person unable to do so because of mental or physical incapacity. The term “ad personam” means “for the person” in Latin. A curator ad personam is therefore only concerned with the personal affairs of the person. As the appointment of a curator ad personam involves a serious curtailment of a person’s rights and freedoms, the court will not lightly make such an appointment.

A curator bonis must furnish security to the Master of the High Court, as a guarantee for doing the job properly. Practising attorneys hold Fidelity Fund certificates, that satisfy this requirement; therefore, only practising attorneys are generally appointed as curators (with a few rare exceptions).

In terms of our common law the High Court may declare a person incapable of managing his or her own affairs, and may appoint a curator to the person and/or property of such person. The procedure for this application is set out in Rule 57 of the Rules of the High Court and includes an application to court in respect of the following persons:

a) Mentally ill or mentally deficient persons;

b) Persons, who owing to physical infirmity cannot manage their own affairs; and

c) Persons declared prodigals.

Procedure for the appointment of a curator:

Initially a request for the application of curatorship is brought to the court by a person who is close to the patient. This can be a friend, family member, caregiver or even an institution.

The court is requested to make an order that the patient is declared of unsound mind and incapable of managing his / her own affairs. This is done with supporting affidavits from two medical practitioners, one of which should be a registered psychiatrist.

The court will then appoint a curator ad litem, normally an Advocate nominated by the applicant or his / her attorney, whose job is to represent the patient and compile a report on the investigation. He / she will present their findings to the Court and the Master of the High Court.

The curator ad litem will then recommend the appointment of a curator ad personam or curator bonis, and the application, together with the curator ad litem’s report is filed with the Master of the High Court, who will subsequently file a report, either supporting the appointment of a curator ad personam and/or curator bonis, or refusing such appointment.

If the Master is in support of the appointment, he will provide a list of the powers to be held by the curator. This is not a numerous clausus and would depend on the various needs of each individual patient and the various assets etc that need to be administered.

The matter will then be set down for a final order by a Judge of the High Court appointing the nominated curator. That curator will then have the legal capacity to administer the estate of the patient.

Summary of application process:

- Application to the High Court (founding affidavit by applicant and supporting documents).

- Medical reports.

- Appointment of curator ad litem.

- Curator ad litem reports to the Court.

- Master’s report supporting the application.

- Final appointment of curator bonis and/or curator ad personam.

Kobus Pieterse | Partner

Areas of Expertise: Litigation, Family Law & Curatorship Applications

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

We are married, but are you my spouse?

Muslim marriages in general, but polygynous Muslim marriages in particular, currently do not enjoy equal protection under South African law. Whilst waiting for Parliament to enact the Muslim Marriages Bill, the courts, in a litigious piecemeal fashion, have been attempting to address the issues faced by those married in terms of Shari’ah law.

Section 2C(1) of the Wills Act of 1953 recently came under scrutiny from the courts. Section 2C(1) provides that when the descendants and surviving spouse of a deceased are to benefit in terms of a will, and the descendants renounce their right to such benefit, the surviving spouse, by operation of law, will receive the repudiated benefit.

An issue with this section arises when one tries to determine who is to be treated as a ‘surviving spouse’. This question arose in the case of Moosa NO and Others v Harneker and Others (2017) when a Muslim husband died, leaving behind a Will in which his descendants were named to benefit, and which included the family home. The children agreed to renounce their benefit in terms of the Will. This triggered the operation of Section 2C(1), which meant that the ‘surviving spouse’ was to receive the repudiated benefit. The deceased was married to two Muslim women in terms of Shari’ah law. The deceased, in order to secure a loan from a bank in the 1980s, had subsequently married one of his wives in terms of civil law.

The Executor of the estate reflected the operations of Section 2C(1) in his liquidation and distribution account, namely that each of the two surviving spouses would receive their respective share of the immoveable property, which the Master of the High Court accepted. When the Executor attempted to register the transfer of the family home into the names of both of the wives, the Registrar of Deeds refused to register the transfer of the property into the name of the wife who was not married to the deceased in terms of civil law, but only in terms of Islamic law.

The Registrar of Deeds refused to accept that the wife married in terms of Islamic law was to be considered as a ‘surviving spouse’ in terms of the Act. The Registrar argued that no court had previously decided what was meant by surviving spouse in terms of the Act. The Registrar argued furthermore that that the Act never intended to include surviving spouses of polygynous Muslim marriages in the ambit of the definition. This was because the Act was silent as to who such a ‘surviving spouse’ is, and when it was promulgated the only legally accepted marital union was one concluded in terms of the Marriage Act. The Registrar of Deeds argued therefore that it had not been the intention of Parliament to include surviving spouses of polygynous Muslim marriages in the ambit of ‘surviving spouse’ in terms of the Act.

The Western Cape High Court agreed that at the time the Act came into effect, Parliament would only have intended to protect monogamous marriages as that was the only legally accepted form of marital union. The Court then examined the consequences of the differentiation and exclusion created by this section in terms of the Bill of Rights contained in the Constitution, namely the right to equality. The court found that Section 2C(1) was unconstitutional as it unfairly discriminated against surviving spouses of polygamous Muslim marriages, based on religion and marital status. In order to remedy this constitutional defect, the court read in (inserted) the following words at the end of section 2C (1) – “For purposes of this sub-section, a ‘surviving spouse’ includes every husband and wife of a de facto monogamous and polygynous Muslim marriage solemnised under the religion of Islam”. It was also ordered that the Registrar of Deeds register the transfer of the property into the names of both of the deceased’s wives. On 29 June 2018 the Constitutional Court handed down a unanimous judgment confirming the earlier ruling of the Western Cape High Court.

For more information regarding Muslim marriages and Estates, please contact:

Rifqah Omar | Partner

E: r.omar@bissets.com

Areas of Expertise: Litigation, Professional Discipline Law, Muslim Personal Law, Curatorship applications and administration, Curatorships, Administration of estates

For more information regarding Wills and Estates, please contact:

Roald Besselaar | Partner

Areas of Expertise: Conveyancing, Estate Law, Wills, Trusts, Curatorships, Property Law

Can the municipality disconnect my water and electricity?

Municipalities monitor services to a property, and may cut off the supply of said services in certain circumstances. However, municipalities also have the responsibility of remaining within the legal boundaries of managing the supply of services to properties.

Accounts in arrears

If one of your municipal services is in arrears, the municipality may disconnect whatever service if there are undisputed arrears owed to any other service in connection with the related property. Before any disconnection takes place, the municipality must follow the necessary procedure.

The municipality is legally obligated to give a notice to the person responsible for the account. A minimum of 14 days written notice of termination is required for water and electricity accounts in arrears and if the notice period is shorter than 14 days, or not supplied, any disconnection is illegal. The 14-day notice gives the responsible party an opportunity to present any disputes or queries they may have regarding the account or allow them to repay the arrears.

In the event of a query lodged with the municipality

Once a query relating to the account has been lodged, the municipality may not disconnect services provided that the amount being queried is equal to the amount in arrears. In the case where the amount is less that the amount in arrears, the service may be disconnected for the undisputed amount owing.

When a query has been logged, it can only be valid as long as the monthly bill or any other related payments are being made to the respective account. If the responsible person does not make any form of payment, the service may be disconnected even if a logged query exists with the municipality.

State where the payment should go

If there is an account dispute and the responsible person makes a payment to the municipality, the municipality may choose to allocate that money to any account they wish. This means the account in need of the payment may not have the payment made into it. To curb this, the responsible person must notify the municipality, in writing, of the payments being made as well as which account they should be allocated to. This must be done before payment is made.

For more information regarding property matters, please contact:

Lisa Visagie | Partner

Areas of Expertise: Property Law & Conveyancing

What to include in a basic lease agreement

If you are considering leasing out your property, it is important that you, as landlord, and the tenant agree on your respective rights and obligations.

A basic lease agreement should at least contain the below information, but in more detail:

- Basic information (who, where, what, duration)

The details of those who are party to the agreement, the address of the property being leased out, and the lease period.

- A deposit and other fees

The purpose of a deposit is to ensure that, should there be any damages to a property due to the tenant’s fault, they could be repaired without the landlord incurring the expenses or waiting for the tenant to pay for said damages.

Remember that the landlord is legally obligated to deposit this money into an interest-bearing account, held with a financial institution. The tenant is entitled to receive the deposit and all interest earned on the money over the period it was held for, after deduction of any damages, at the end of the lease agreement.

- Responsibilities, repairs and maintenance of the premises

Landlords are not able to oversee everything the tenant does, and this is where the responsibility and maintenance clause comes in. If the property’s utilities will be included in the rent, it should be stipulated and not assumed. It must be explicit who will be responsible for the general upkeep, such as mowing the lawn or cleaning the pool. An oral agreement will not suffice because if it is not in writing, it is easy to challenge in future.

- Subletting and limits on occupancy

All the adults who will be living on the premises should be party to the agreement; their names, details and signatures must be provided. This allows for the landlord to determine who may live on the property and serves as proof that these are the occupants that he/she has approved. Explicitly state in the agreement whether subletting is allowed or not.

- Rent payment

It is very important to state the rent payable, as well as annual escalation in the event of a longer lease. In addition, details regarding the amount, date on which it is to be paid, acceptable payment methods, and repercussions of failing to meet these requirements, must be included.

- Termination of the lease

The terms that warrant a lease to be terminated must be included in the agreement.

- Pets

If pets are allowed on the property, descriptive limitations and restrictions must be included.

For more information regarding lease agreements, please contact:

Henning Pieterse | Partner

Areas of Expertise: Corporate & Commercial Law

It’s tax season – Make sure you declare your Bitcoin gains!

Bitcoin… Ethereum… Litecoin… Dash…

You may have been trading in cryptocurrencies over the past tax year. You may also have recently sold some of your long-term cryptocurrency investments. With tax season on the horizon, it is essential that firstly you declare your gains in your tax returns, and secondly that you declare your gains correctly, to avoid potential penalties and possibly even criminal charges.

How are the gains from your cryptocurrencies taxed? The South African Reserve Bank does not regard cryptocurrencies as legal tender, nor does the Income Tax Act 58 of 1962 define “cryptocurrencies”. As a result, there appears to be confusion surrounding the taxation of cryptocurrencies.

The South African Revenue Services released a statement in April 2018 that it intends to regard the taxation of cryptocurrencies in accordance with the normal income tax rules of South African tax law.

In terms of the normal income tax rules of South African tax law, the gains from the sale of cryptocurrencies will either be taxable as a capital gain or as a revenue gain, depending on whether the cryptocurrencies were held as capital assets or revenue assets. The test applied when considering whether profits on cryptocurrencies should be taxed as revenue or capital assets will involve the taxpayer’s intention, both at the outset and whilst holding the assets/cryptocurrency. If the intention at the outset is to make a profit (amongst other things), or the intention changes so that the taxpayer has “crossed the Rubicon” by embarking on a scheme of profit-making, it is likely to be taxed as a revenue asset. If the taxpayer invests with a view to holding the cryptocurrencies long-term (similar to a long-term property investment) then the profits are likely to be taxed as a capital asset.

Beware that SARS is likely to focus their attention on the taxation of cryptocurrencies in the coming months, including exploring the use of technology to track the movement of cryptocurrencies belonging to South African tax residents.

Should you require assistance with your tax returns, or advice regarding the taxation of your cryptocurrencies, get in touch with our tax experts who will be able to assist you.

Erlise Loots | Partner

Areas of Expertise: Tax, Curatorships, Trusts, Estates, Exchange Control & Non-resident services and advice

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)

Some helpful advice

- Prepare your property insurance in advance, to ensure that your property will be insured once it is registered in your name. This can be arranged through your bank if you will be registering a mortgage bond.

- When you sell your property, you may pay capital gains tax to the South African Revenue Services. You will need copies of all invoices relating to capital expenditure on the property for when you sell, as it is difficult to claim capital expenditure deductions if you do not have supporting documentation. Our tax department can assist you with calculating your capital gains tax obligations. We can also assist you with the safekeeping of your records. Visit our Tax Department here

Erlise Loots | Partner

Areas of Expertise: Tax, Curatorships, Trusts, Estates, Exchange Control & Non-resident services and advice

The transfer process

If no transfer date is specified in the agreement of sale, registration of transfer of property into the purchaser’s name can usually take place within 2-3 months after the fulfilment of any suspensive conditions (assuming that both parties perform timeously).

The seller’s conveyancer usually performs the transfer, and oversees the process. As a purchaser, you are entitled to request that your attorney also assist you in overseeing the transfer process to keep you informed along the way, even though the seller’s conveyancer will do the actual registration of transfer. Usually this will result in an extra cost for you.

The following are the usual steps in an ordinary transfer:

- Agreement of sale is signed.

- The conveyancer establishes contact with the parties and collects important information such as FICA.

- The conveyancer requests guarantees and/or payment of the purchase price from the purchaser to secure the purchase price.

- The conveyancer requests advance municipal rates clearance figures from the municipality in order to obtain a rates clearance certificate.

- The conveyancer prepares the transfer documentation for signature, which both parties must sign.

- The conveyancer requests a transfer duty receipt/ a transfer duty exemption receipt (in the event that the sale is subject to VAT) from the South African Revenue Services, which the purchaser must pay.

- The conveyancer requests a levy clearance certificate from the home owners association and/or body corporate (where applicable).

- The conveyancer prepares all documents to be lodged at the deeds office and subsequently lodges the transfer at the deeds office for registration.

- The deeds office examines whether all documents are in order, and if everything is in order, registration can be effected within 5-15 working days (depending on whether the deeds office is experiencing a backlog).

- Registration of transfer is registered, and the seller is paid.

In the event that a mortgage bond is registered over the property it will need to be cancelled on registration of transfer. If the purchaser is financing the purchase via a mortgage bond, additional steps will need to be followed and the mortgage bond will be registered simultaneously with the registration of the transfer into the purchaser’s name.

Robert Ferrandi | Managing Partner

Areas of Expertise: Property Law & Conveyancing

Carl Burger | Partner

Areas of Expertise: Property Law & Conveyancing

Michelle van Wyk | Partner

Areas of Expertise: Property Law & Conveyancing

Lisa Visagie | Partner

Areas of Expertise: Property Law & Conveyancing

Ronél Els | Partner

Areas of Expertise: Property Law & Conveyancing